Gardeners face risks in their trade, often working on private properties and interacting closely with clients. Public liability and Products Liability insurance is important for gardening businesses as they have the risk of causing third-party injury and third-party property damage while performing their work. Here, we explore common scenarios where this type of coverage may help safeguard your gardening business and offer peace of mind.

Gardeners face risks in their trade, often working on private properties and interacting closely with clients. Public liability and Products Liability insurance is important for gardening businesses as they have the risk of causing third-party injury and third-party property damage while performing their work. Here, we explore common scenarios where this type of coverage may help safeguard your gardening business and offer peace of mind.

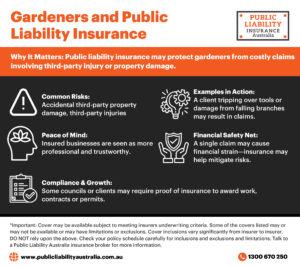

Common Risks for Gardeners *

Gardening involves more than just tending to plants. Many tasks carry inherent risks, including:

- Accidental Property Damage

A gardener using equipment might damage a client’s fence, patio, or prized flower bed. These repairs could result in expensive claims against the business. A common claim we see is broken windows, for example, a garden is mowing the lawn and a rock flies through a home window. - Third-Party Injuries

Tools left unattended or slippery surfaces caused by irrigation systems could lead to accidents, such as a client tripping and injuring themselves. - Equipment Mishaps

Equipment like lawn mowers or hedge trimmers might cause unintended damage to property or harm to others, even with the most experienced operator.

How Public Liability Insurance May Help *

Public liability insurance is designed to cover claims made by third parties for injury or property damage caused by business operations. For gardeners, this may mean financial protection against claims and related legal costs. Some scenarios where coverage may apply include:

- Property damage costs – e.g., Replacement cost for broken glass window

- Third-party injury costs – e.g., the business is held liable for causing personal injury to a client and the business is sued for damages

Having this insurance may not only protect your finances but also help maintain your professional reputation. Clients are more likely to trust a business that has coverage, knowing that it takes their safety and property seriously. We often find that businesses are asked to have public & products liability in place by their clients, especially when taking on larger jobs.

Examples of Coverage in Action *

- Accidental Damage to Property

During a routine hedge trimming, a falling branch cracks a client’s window. Public liability insurance may help cover the repair costs. It’s important to note, many gardening policies will not cover trimming of trees/branches where the tree is above 3m or 5m in height. If trees exceed this height, you need to let your broker know. - Third-Party Injury

A client trips over a hose left on the driveway and suffers a minor fracture. The client sues your business for the damages. Public & products liability cover can pay for the damages. - Neighbouring Property Claims

Fertiliser runoff damages a neighbouring vegetable patch. Coverage may extend to these types of claims, depending on the policy.

Why Public Liability Insurance is Important for Gardeners *

Gardening often involves physically demanding tasks, specialised equipment, and environments that vary from one job to the next. These factors increase the likelihood of unforeseen incidents, and a single claim could place significant financial strain on a small business. Public liability insurance offers a safety net, helping gardeners focus on their work without undue worry about potential liabilities.

Additionally, some clients or local councils may require proof of public liability insurance before granting work, contracts or permits, making it a valuable investment in growing your business.

Conclusion *

Public liability insurance may provide vital protection for gardeners, covering potential costs of third-party injury or property damage claims. By securing this coverage, gardeners can mitigate financial risks and show clients they are covered if there as an incident. If you’re considering public liability insurance, consult with a business insurance broker to find a policy tailored to your gardening business activities and needs.

Disclaimer: The content of this blog article is intended for general informational purposes only and should not be considered as professional advice. While we strive to ensure accuracy, we make no guarantees about the completeness or reliability of the information. For guidance regarding what and how much public liability insurance cover you need, we recommend consulting with a business insurance broker. Any actions you take based on any information provided here are at your own discretion.