Running a business comes with risks, and despite taking precautions, accidents may happen. If a third party—such as a customer, supplier, or passerby—files a public liability insurance claim against your business, it’s important to respond promptly and appropriately. Here’s a step-by-step guide on what to do if you receive a public liability claim.

Running a business comes with risks, and despite taking precautions, accidents may happen. If a third party—such as a customer, supplier, or passerby—files a public liability insurance claim against your business, it’s important to respond promptly and appropriately. Here’s a step-by-step guide on what to do if you receive a public liability claim.

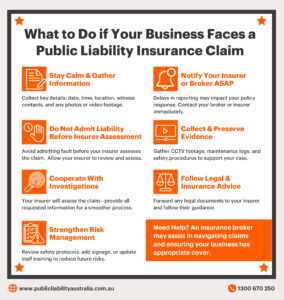

- Stay Calm and Gather Information

The first step is to remain calm and collect all relevant details about the incident. This may include:

- The date, time, and location of the event

- A description of what happened

- Names and contact details of the affected party and any witnesses

- Photographs or video footage of the scene, if available

This information may be valuable when responding to the claim and assisting your insurer in their investigation.

- Notify Your Insurance Broker or Insurer

As soon as you are made aware of a claim, contact your insurance broker or insurer. Delays in reporting a claim may affect how your policy responds, so it’s best to notify them as soon as possible. Your broker can help guide you through the claims process and communicate with the insurer on your behalf.

- Avoid Admitting Liability

It’s natural to want to resolve the situation quickly, but admitting fault—either verbally or in writing—before your insurer has assessed the claim may affect your coverage. Instead, stick to the facts and allow your insurer to handle communications with the claimant.

- Collect and Preserve Evidence

To support your defence, gather any available evidence, such as:

- CCTV footage, if applicable, or photographs

- Maintenance logs or records related to the incident

- Copies of any safety policies or procedures that your business has in place

Providing thorough documentation may help strengthen your case and assist your insurer in determining the validity of the claim.

- Cooperate With Your Insurer’s Investigation

Once your claim is lodged, your insurer will assess the facts and circumstances of the matter. This may involve reviewing the supporting information provided, interviewing witnesses, liaising with any other insurer(s) that may be involved and assessing whether your business has any liability in the matter. Cooperating fully with the insurer and any appointed assessor during this process can help ensure a smoother resolution.

- Follow Legal and Insurance Advice

Your insurer may provide legal representation if the claim escalates to a lawsuit. If you receive any legal documents, forward them immediately to your insurer or broker for handling.

- Implement Risk Management Strategies

Regardless of the outcome of the claim, it may be a timely reminder to assess your business’s risk management strategies. Reviewing safety protocols, implementing additional signage, or updating staff training are ways you can help reduce the risk of future incidents.

Final Thoughts

Facing a public liability claim can be stressful, but following the right steps may help you navigate the situation effectively. By notifying your broker or insurer promptly, gathering evidence, and cooperating with the claims process, you may help protect your business from potential financial and reputational damage.

Need Assistance With Public Liability Insurance?

If you want to review your business insurance or need guidance on a public liability claim, speaking with a public liability insurance broker may help. Brokers may assist in comparing policies and ensuring your business has appropriate cover.

Disclaimer: The content of this blog article is intended for general informational purposes only and should not be considered as professional advice. While we strive to ensure accuracy, we make no guarantees about the completeness or reliability of the information. For guidance regarding what and how much public liability insurance cover you need, we recommend consulting with a business insurance broker. Any actions you take based on any information provided here are at your own discretion.