As a business owner, understanding different types of liability insurance is key to protecting your operations. One coverage you may encounter is broadform liability insurance. But what exactly is it, and how can it help protect your business?

What is Broadform Liability Insurance? *

What is Broadform Liability Insurance? *

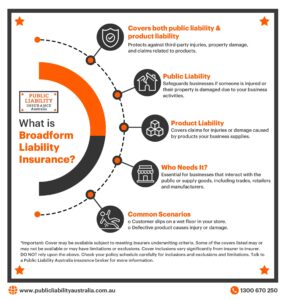

Broadform liability insurance is a type of insurance that may provide coverage for multiple risks associated with running a business. It is a comprehensive form of coverage that typically combines public liability and product liability insurance. This policy aims to protect businesses from third-party claims resulting from injury or property damage that occurs due to their operations, services, or products.

Unlike standard liability policies that may have specific limitations or exclusions, broadform liability insurance may provide wider coverage. This may include incidents that occur on your premises, issues that arise during offsite operations or from the products you manufacture or supply.

What Does Broadform Liability Insurance Cover? *

Broadform liability insurance can cover a variety of risks, which may include:

- Third-party personal injury claims: If a customer, visitor, or third party suffers an injury on your business premises or due to your business activities, broadform liability insurance may cover medical costs and legal fees.

- Third-party property damage claims: May cover costs if your business causes accidental damage to a third party’s property. For instance, if a contractor accidentally damages a client’s property while working, the insurance may cover the repair costs.

- Product liability: If your business manufactures or supplies products, broadform liability may cover claims that arise from defective products that cause injury or property damage.

- Legal defence costs: One of the major benefits of broadform liability is that it may covers legal fees. This may apply even if a claim made against your business is found to be unsubstantiated.

How Can Broadform Liability Insurance Protect Your Business? *

Running a business in Australia comes with inherent risks, and broadform liability insurance may provide several key protections:

- Financial Security: The cost of defending a liability claim and paying any resulting damages can be significant. Broadform liability insurance may help cover these costs, protecting your business from the financial strain of unexpected incidents.

- Legal Support: If a claim is brought against your business, the legal costs can be considerable. Broadform liability insurance typically includes coverage for relevant legal fees, which can ease the burden on your business. This may allow you to focus on your business operations rather than worrying about how you are going to fund courtroom battles out of your own pocket.

- Comprehensive Protection: This type of insurance may offer broader coverage than standard liability policies, which may reduce the need for multiple separate policies. By covering public and product liability, broadform insurance simplifies your insurance arrangements while offering comprehensive protection.

- Confidence in Business Operations: Knowing that you have broadform liability insurance can provide peace of mind, allowing you to run your business with confidence. Whether you operate from a physical location, perform work offsite, or supply products, this insurance may help reduce your concerns about the impact of potential accidents and claims.

Is Broadform Liability Insurance Suitable for Your Business? *

Whether you’re a sole trader or manage a growing business, broadform liability insurance may be a suitable option if your business interacts with the public or involves higher-risk activities. This could include businesses in the construction, retail, or manufacturing industries, where serious incidents involving third parties frequently occur.

However, it is important to carefully review the terms and conditions of any policy, as coverage details can vary between providers. Consulting with a business insurance broker, such as the team at Public Liability Insurance , may help ensure that you understand your coverage and tailor it to your specific risks.

Conclusion *

Broadform liability insurance is a flexible and comprehensive form of coverage that may provide protection for businesses facing a range of third-party claims. From personal injury to property damage and product liability, this type of insurance may help safeguard your business from potentially devastating financial losses. For a clearer understanding of how broadform liability insurance could benefit your business, consider speaking with our insurance brokers.

Disclaimer: The content of this blog article is intended for general informational purposes only and should not be considered as professional advice. For guidance regarding what and how much broadform liability insurance cover you may need, we recommend consulting with a business insurance broker.