Public liability insurance is designed to protect Australian businesses from third-party claims of injury or property damage that occur due to their business activities. However, like any insurance policy, there are limitations and exclusions. Understanding what public liability insurance does not cover is just as important as knowing what it does. While In Australia, Public liability insurance varies from insurer to insurer, we outline some common exclusions and provide examples relevant to common trade and retail industries.

Public liability insurance is designed to protect Australian businesses from third-party claims of injury or property damage that occur due to their business activities. However, like any insurance policy, there are limitations and exclusions. Understanding what public liability insurance does not cover is just as important as knowing what it does. While In Australia, Public liability insurance varies from insurer to insurer, we outline some common exclusions and provide examples relevant to common trade and retail industries.

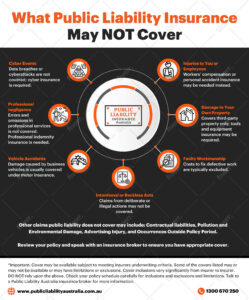

Common Exclusions in Public Liability Insurance

- First-Party/Employee Injuries

Public liability insurance generally does not cover injuries to yourself or your employees. Instead, workers’ compensation insurance is typically required to provide cover for work-related injuries or illnesses suffered by employees.

Example:

A cleaning business employs staff to provide services to clients. If a passer-by slips and trips public liability make cover their medical expenses. However, if the cleaner slips and injures themselves while mopping a floor, public liability insurance is unlikely to cover their medical costs or lost income. Instead, the business may need workers’ compensation insurance, or income protection/personal accident insurance if they are an individual.

- Damage to Your Own Property

Public liability insurance is designed to cover damage to third-party property, not your own business property, tools, or equipment. If you want cover for damage or loss of your business assets, you may need commercial property insurance or a tools and equipment policy.

Example:

A gardening business accidentally damages a client’s fence while trimming hedges. Public liability insurance may help cover the cost of repairs. However, if the gardener’s own hedge trimmer is damaged or lost in the process, it would not be covered under public liability insurance. Instead, tools and equipment insurance may be needed.

- Faulty Workmanship

If your business provides a service that results in defective work, public liability insurance may not cover the cost of fixing or redoing the job.

- Intentional, Recklessness and Criminal Acts

If damage or injury occurs due to intentional or illegal acts, public liability insurance is unlikely to provide cover. This includes situations where a business knowingly engages in reckless or fraudulent behaviour.

Example:

A catering company serves food at an event, and a staff member knowingly ignores food safety protocols, leading to food poisoning. If the negligence was deemed intentional, or there was wilful failure to take care, public liability insurance may not cover the resulting claims.

- Contractual Liabilities

If a business enters into a contract that extends beyond standard liability risks, public liability insurance may not cover any associated claims. Businesses should carefully review contract terms and consider additional coverage if necessary.

Example:

A cleaning company signs a contract stating they will be responsible for any and all damages that occur at a client’s premises. If an incident arises that goes beyond what public liability insurance typically covers, the business may be left liable for the costs.

- Vehicle Accidents

Public liability insurance does not cover damage or injury caused by vehicles used for business purposes. Instead, a commercial vehicle insurance policy may be required.

Example:

A handyman drives their work ute to a client’s house and accidentally reverses into their garage door. Public liability insurance is unlikely to cover the damage, as vehicle-related incidents fall under motor insurance.

- Pollution and Environmental Damage

Damage caused by pollutants, chemicals, or environmental contamination is usually excluded unless specifically included in a policy extension.

Example:

A gardening business uses pesticides, and a spill causes damage to a nearby property’s water supply. Public liability insurance may not cover the costs of environmental damage or clean-up.

- Product Liability Issues

If your business manufactures or sells products, any claims related to defects or injuries caused by those products may not be covered under public liability insurance. A separate product liability insurance policy or a combined public and products liability may be needed. While public liability insurance and product liability are combined for many businesses in Australia, it’s important to check that there is specific product liability wording included.

Example:

A catering business supplies pre-packaged meals to customers, and a batch is found to contain undeclared allergens, causing allergic reactions. Public liability insurance may not cover claims arising from faulty products. Product liability wording is required,

- Professional Negligence

Public liability insurance generally does not cover civil liability arising out of the provision of your professional services. This would instead be covered under a professional indemnity insurance policy.

Example:

An accountant provides tax advice to a client, but due to an error in their calculations, the client ends up underpaying their taxes. As a result, the client faces penalties and interest from the tax authorities and sues the accountant. Public liability insurance would not cover such circumstances, and professional indemnity insurance would be needed.

- Advertising Injury

Some public liability insurance policies will include cover for advertising injury, for injuries arising out of defamation, misleading or deceptive conduct, infringement of copyright or privacy. However, this may not always be the case, and exclusions may be imposed under certain circumstances, for example if your service offering revolves around advertising or marketing for other businesses.

Example:

An advertising agency publishes content on their client’s social media platform which contains copyrighted material. This would not be covered by public liability insurance – professional indemnity insurance would be required in such cases.

- Occurrences Outside Policy Period

Public liability insurance in most cases is offered as an occurrence-based cover. This means you can only claim for incidents that have occurred during the period of insurance.

Example:

A cleaning business accidentally stains a benchtop with cleaning chemicals and decides to take out a public liability insurance policy the next day. The stained benchtop would not be covered because it occurred before the policy was taken out.

- Cyber Events

If you keep personally identifiable information of customers or other third parties in your IT systems, data breaches would not be covered by public liability insurance.

Example:

An online store experiences a cyber attack and customers’ addresses and payment information are compromised. This would not be covered by a public liability insurance policy; cyber insurance would be required in such instances.

Conclusion

Public liability insurance may provide valuable protection for businesses that deal with the public. However, there are limits to what it covers. Business owners should carefully review their policy’s exclusions and speak with an insurance broker to ensure they have appropriate cover for their specific risks.

For guidance on choosing suitable insurance, it may be helpful to speak with a business insurance broker.

Disclaimer: The content of this blog article is intended for general informational purposes only and should not be considered as professional advice. While we strive to ensure accuracy, we make no guarantees about the completeness or reliability of the information. For guidance regarding what and how much public liability insurance cover you need, we recommend consulting with a business insurance broker. Any actions you take based on any information provided here are at your own discretion.