The average small business owner pays approximately $800 per annum, or $66 per month, for public liability insurance, according to data collected by major Australian insurance providers. However, the amount that you actually pay depends on the characteristics of your business. Factors affecting the price include the size of your company and the risks of operating in your particular industry.

Public Liability Insurance Costs: Breaking It Down*

The average business pays approximately $800 per annum, or $66 per month, on public liability insurance to cover against negligence. But what does the distribution look like?

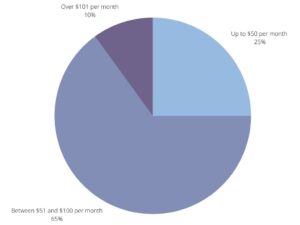

The following chart categorises businesses into different payment amount groups, and the amount each group pays:

As you can see from the chart, the vast majority of small businesses pay below $100 per month. And a quarter pay less than $50 per month.

There is no set upper limit for the amount of liability insurance coverage you need to buy. Most enterprises will top out at $20 million, but there could be reasons to go higher. Some enterprises might benefit from choosing a lower threshold to get a lower premium, but only under advice from their insurance provider or broker.

What Factors Affect Public Liability Insurance Costs?*

The following factors affect how much you’re likely to pay for public liability insurance.

The Size Of Your Enterprise

As you add more people to your enterprise, the likelihood of negligence rises. Somebody somewhere in your organisation will do something that injures somebody or causes property damage. It’s the law of large numbers in action.

Suppose you operate a mobile hairdressing business and increase staff on your payroll from 2 to four. All else being equal, your business is now doubly likely to injure a client.

While you are likely to see your public insurance premium increase it is unlikely to double as you business begins to benefit from some economies of scale.

The Type Of Business You Operate

The risks of a business committing negligence, where a public liability policy will respond, vary wildly from one industry to the next. Consultants working from home, for instance, are lower risk prospects for insurers than tradies going from worksite to worksite. Likewise, construction industry firms face higher premiums than online tutors because of the physical risks of the working environment.

In general, amongst trade occupations, plumbing and gas services businesses pay one the highest average liability premiums, while another costly sector is commercial cleaning services. Domestic cleaning services pay less, close to the overall average annum premium, while handymen come in slightly under the average.

The Location Of Your Business

Where you locate your business can also have an impact on the public liability premiums you may pay. Companies operating in airports, mines or railway stations often have higher premiums. Again, this has to do with the risks of negligence associated with these sites and the magnitude of the consequences should negligence occur.

The Level Of Cover

Public liability insurance provides businesses with varying levels of cover, mostly ranging from around $5 million to $20 million. The purpose of this cover is to pay legal fees and compensation if a victim completes a successful case against the firm.

Monthly public liability premiums typically rise the greater the level of cover.

How much cover you choose ultimately depends on the kinds of risks you and your insurer believe you face. As discussed, it is not always necessary to choose the highest level of cover if payouts of that size are unlikely.

Note that premiums and cover do not scale equally. Again, double the amount of cover doesn’t necessarily mean that you have to pay twice as much to your insurer every month. That’s because the vast majority of companies never require cover in the $5 million to $20 million range. Insurers know that these sorts of pay-outs are low probability events, and so the marginal cost of providing additional cover is low.

Conclusion

With public liability insurance, when you opt for a higher the amount of amount of cover, your pro rate value will typically be better. Furthermore, the distribution is heavily skewed towards the lower end, making average premium statistics a little misleading.